Today!

Thank-A-Thon

Dillard University offers degrees in the Arts, Business, Humanities, Nursing, STEM, and more. Visit our academic programs today!

Dillard University students become leaders, thinkers, and artists, learning to think critically and act with integrity to make a difference and inspire others to join their mission.

DU COMMUNIVERSITY

Dillard University is the only University in America with a program in African American material culture and the first HBCU to offer a bachelor’s degree in theater Film Studies B.A. Degree.

NEWS

21 Selected for Dillard University’s Inaugural HEAL Professional Program to Transform Healthcare Advocacy for Breastfeeding Families

The Minority Health and Health Equity Research Center

Rev. Dr. Dominique A. Robinson to Serve as 2024 Baccalaureate Service Speaker

Dillard University is pleased to announce that the esteemed Rev. Dominique A.

Dillard University Advances to 35th Honda Campus All-Star Challenge National Championship Tournament

Dillard University Scholars Compete in 35th HCASC Nationals, vying for

DILLARD UNIVERSITY BECOMES A GROUNDWATER MONITORING SITE

Dillard Joins Deltares’ Disaster Resilience Water Network

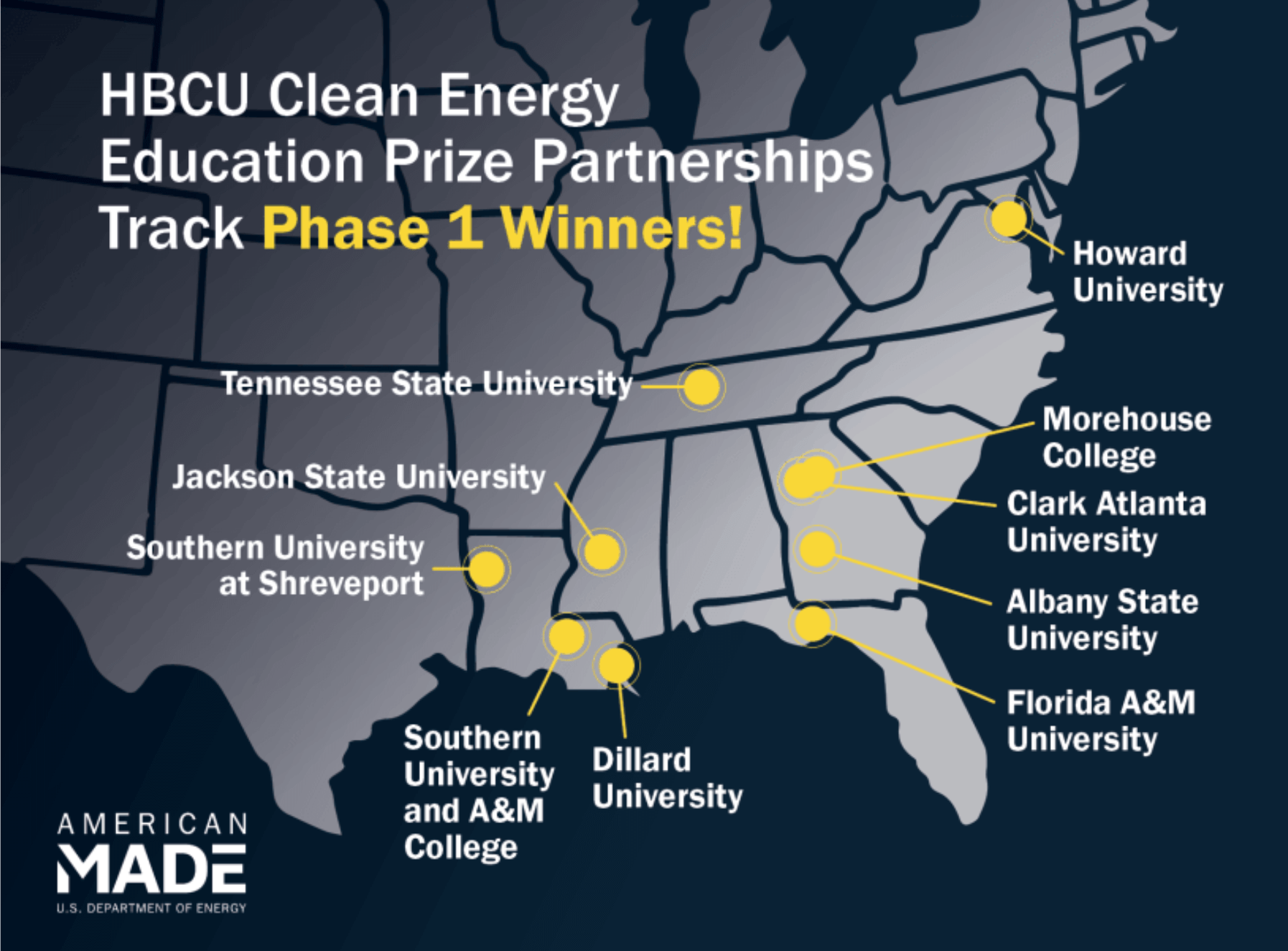

Dillard University Awarded $100K to Support Clean Energy Programming

Dillard Among Inaugural HBCU Clean Energy Prize Winners by

Dillard University Announces President of Disney Branded Television Ayo Davis as 2024 Keynote Commencement Speaker

President Rochelle L. Ford announced that Ayo Davis,

president of

Dillard University Among Top Seven in HBCU Battle of the Brains Competition

Dillard University showcased its top-tier Black talent on the national

Dillard University Welcomes Prospective Students for Spring Preview Weekend

The recent Dillard University Spring Preview Weekend held on Friday,

Dillard is Among 15 Recipients of Funding Bill Sponsored by Congressman Troy A. Carter, Sr. and Senator Bill Cassidy

Dillard University is the recipient of one of fifteen Community

Trustee Judge Carl Stewart, ’71, served as Founders’ Day Speaker and was honored with Trailblazer Award at Centenary College

Trustee Judge Carl Stewart, ’71, served as Founders’ Day Speaker

EVENTS

AT DU

Decision Day

BECOME A BLEU DEVIL!

Experience the legacy, the culture, and the community at Dillard University, Louisiana’s oldest HBCU. Your journey starts here.